Economic Developments Driving the Naira’s 4.9% Slide in April

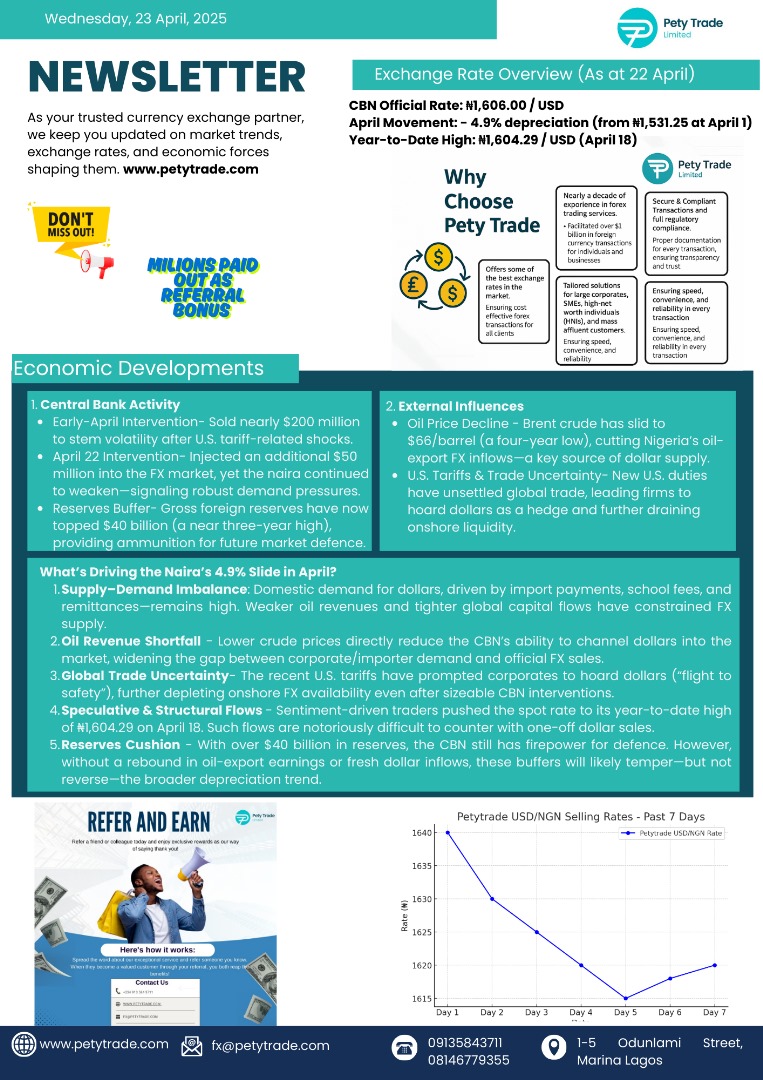

Nigeria’s foreign exchange market has seen renewed volatility in April, with the naira depreciating by 4.9% against the U.S. dollar. Below, we explore the central bank’s activities, external pressures, and underlying macroeconomic forces contributing to this movement.

- Central Bank Activity

Early-April Intervention – Sold nearly \$200 million to stem volatility after U.S. tariff-related shocks.

April 22 Intervention – Injected an additional \$50 million into the FX market, yet the naira continued to weaken—signaling robust demand pressures.

Reserves Buffer – Gross foreign reserves have now topped \$40 billion (a near three-year high), providing ammunition for future market defence.

- External Influences

Oil Price Decline – Brent crude has slid to \$66/barrel (a four-year low), cutting Nigeria’s oil-export FX inflows—a key source of dollar supply.

U.S. Tariffs & Trade Uncertainty – New U.S. duties have unsettled global trade, leading firms to hoard dollars as a hedge and further draining onshore liquidity.

What’s Driving the Naira’s 4.9% Slide in April?

Supply–Demand Imbalance

Domestic demand for dollars, driven by import payments, school fees, and remittances—remains high. Weaker oil revenues and tighter global capital flows have constrained FX supply.

Oil Revenue Shortfall

Lower crude prices directly reduce the CBN’s ability to channel dollars into the market, widening the gap between corporate/importer demand and official FX sales.

Global Trade Uncertainty

The recent U.S. tariffs have prompted corporates to hoard dollars (“flight to safety”), further depleting onshore FX availability even after sizeable CBN interventions.

Speculative & Structural Flows

Sentiment-driven traders pushed the spot rate to its year-to-date high of ₦1,604.29 on April 18. Such flows are notoriously difficult to counter with one-off dollar sales.

Reserves Cushion

With over \$40 billion in reserves, the CBN still has firepower for defence. However, without a rebound in oil-export earnings or fresh dollar inflows, these buffers will likely temper—but not reverse—the broader depreciation trend.